Cover all financing and funds including debt

$2.5 Billion Qatar Green Bond Attracts Strong Investor Interest

Underscoring the growing appetite for sustainable investment opportunities globally, the $2.5 billion green bond was met with overwhelming investor interest, attracting bids worth more than three times the offered amount.

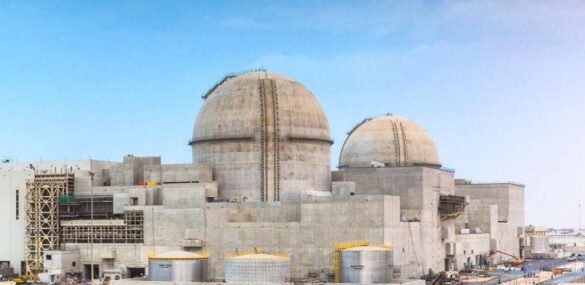

Barakah Nuclear Plant Refinancing Gets ESG Loan Deal of the Year

The refinancing was transformed into a green loan, marking it as the first in the Middle East and North Africa (MENA) region and Asia to gain independent recognition as a green loan facility.

GPS Renewables Secures $50 Million in Debt Financing

The company has previously raised $20 million in equity funding from Neev Fund II by SBICap Ventures, Netherlands-based Hivos-Triodos Fund and Hyderabad-based Caspian Impact Investments.

RBI’s Move to Allow Foreign Investments in Green Bonds Accelerates India’s Green Revolution

The government has a stated target of raising ₹20,000 crore (US$2.4 billion) via SGrB issuance in FY24, with ₹12,000 crore (US$1.4 billion) planned to be raised in the first half of FY25.

Grasim Raises ₹1,250 crore from IFC Through Sustainability Bonds

The proceeds from this initiative will be directed towards supporting decarbonization efforts within its new paint-manufacturing business.

Sustainable Bonds Market: $1 Trillion on the Horizon, Says S&P

This growth comes despite some economic uncertainties, driven by increased transparency, emerging market participation, and strong demand for environmental and energy transition projects.

Borosil Renewables Stock Price Rises on Anti-dumping Probe Announcement

Surged by 11% following India’s initiation of an anti-dumping investigation, the stock price climbed to ₹598.65 per share during today’s intraday trade.

Mufin Green Finance to Get Rs 340 cr Capital Boost from the New Acquisition

Mufin Green Finance last week revealed that it had secured Rs 140 crore in Series B funding, adding to the Rs 530 crore raised in debt funding in the previous fiscal year.

DFSA Launches ESG Fee Waiver, Emirates NBD the First Beneficiary

This is the first such fee waiver as announced by DFSA during COP28, aiming to bolster sustainable capital markets within the Dubai International Financial Centre.

Brookfield Raises $10 Billion for Second Climate Transition Fund

This fund focuses on investments driving the transition to a net-zero economy.