Barakah Nuclear Plant Refinancing Gets ESG Loan Deal of the Year

The refinancing was transformed into a green loan, marking it as the first in the Middle East and North Africa (MENA) region and Asia to gain independent recognition as a green loan facility.

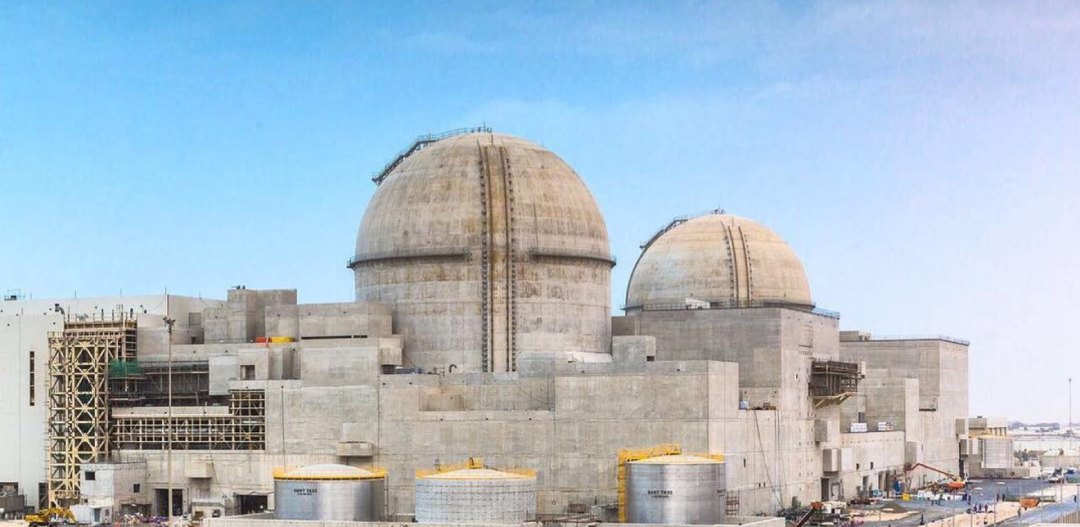

In a significant recognition of sustainable finance, the Barakah Nuclear Energy Plant’s AED 8.89 billion ($2.42 billion) refinancing has been awarded the ESG Loan Deal of the Year at the Bonds, Loans & Sukuk Middle East Awards. This landmark deal was orchestrated by Barakah One Company, a subsidiary of the Emirates Nuclear Energy Corporation (ENEC), with significant contributions from two leading UAE banks, First Abu Dhabi Bank (FAB) and Abu Dhabi Commercial Bank (ADCB).

The refinancing, noted for its competitive market process, was transformed into a green loan, marking it as the first in the Middle East and North Africa (MENA) region and Asia to gain independent recognition as a green loan facility. FAB led the initiative as the Senior Green Coordinator, while ADCB facilitated its execution as the Green Loan Coordinator.

The Barakah Nuclear Energy Plant, positioned as the Arab World’s pioneer nuclear energy facility, is set to achieve full commercial operation later in 2024. The plant is expected to generate 40 terawatt-hours of electricity annually, preventing the release of 22.4 million tons of carbon emissions each year.

ENEC’s Managing Director and CEO, His Excellency Mohamed Al Hammadi, expressed pride in the recognition, emphasizing the project’s crucial role in the UAE’s decarbonization efforts and its contribution to the development of a green economy. “The Barakah plant not only supplies reliable and clean electricity but also significantly contributes to the local economy by creating jobs and fostering the local supply chain,” stated Al Hammadi.

Nasser Al Nasseri, CEO of Barakah One Company, also highlighted the importance of nuclear energy in supporting the energy transition and mitigating climate risks. “It’s essential that the financial viability of such projects is recognized, and we are honoured by this prestigious award,” Al Nasseri added.

Since 2014, the Bonds, Loans & Sukuk Middle East Awards have been acknowledging standout financial deals that reflect innovation and economic strength within the region.

Read More

Carbon Offsetting Service by Mashreq and Fils to Transform UAE Sustainability Practices